Housing stock in Poland

Housing stock in Poland

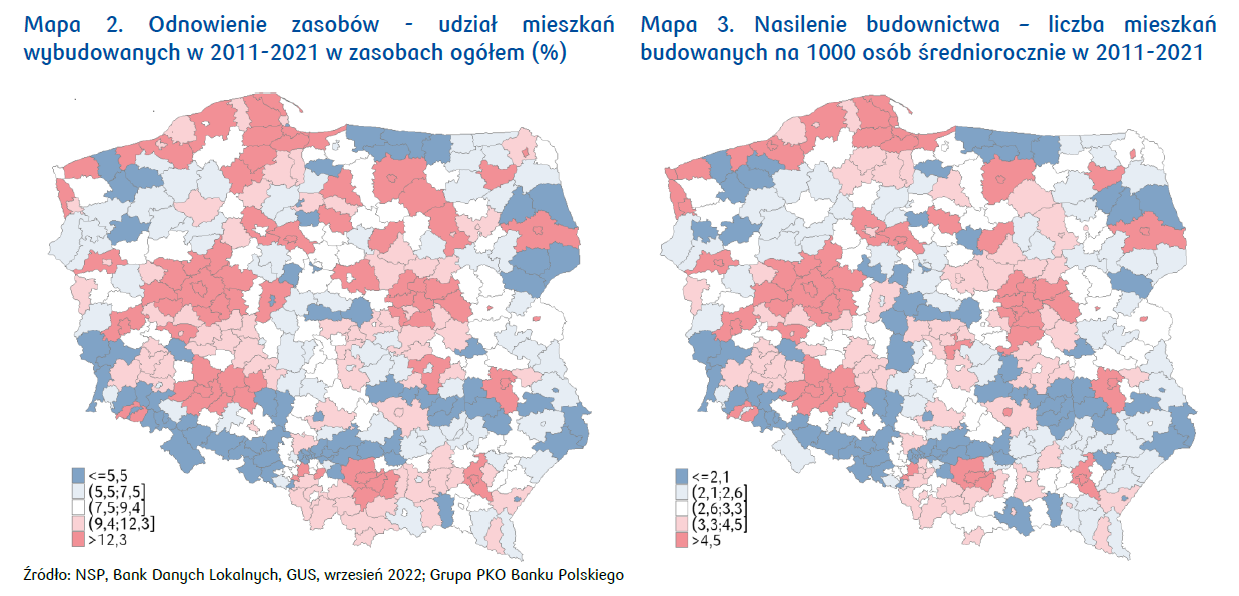

Over the past 10 years (2022 data), 1.7 million apartments have been built in Poland. The share of new construction in total resources is on average 11.3%, so there has been a significant renewal of resources in the country.

Over the past 10 years (2022 data), 1.7 million apartments have been built in Poland. The share of new construction in total resources is on average 11.3%, so there has been a significant renewal of resources in the country.

Significant renovation of the housing stock has taken place in the largest and largest cities, in the districts bordering the largest agglomerations, as well as in tourist-attractive districts, especially in the coastal strip.

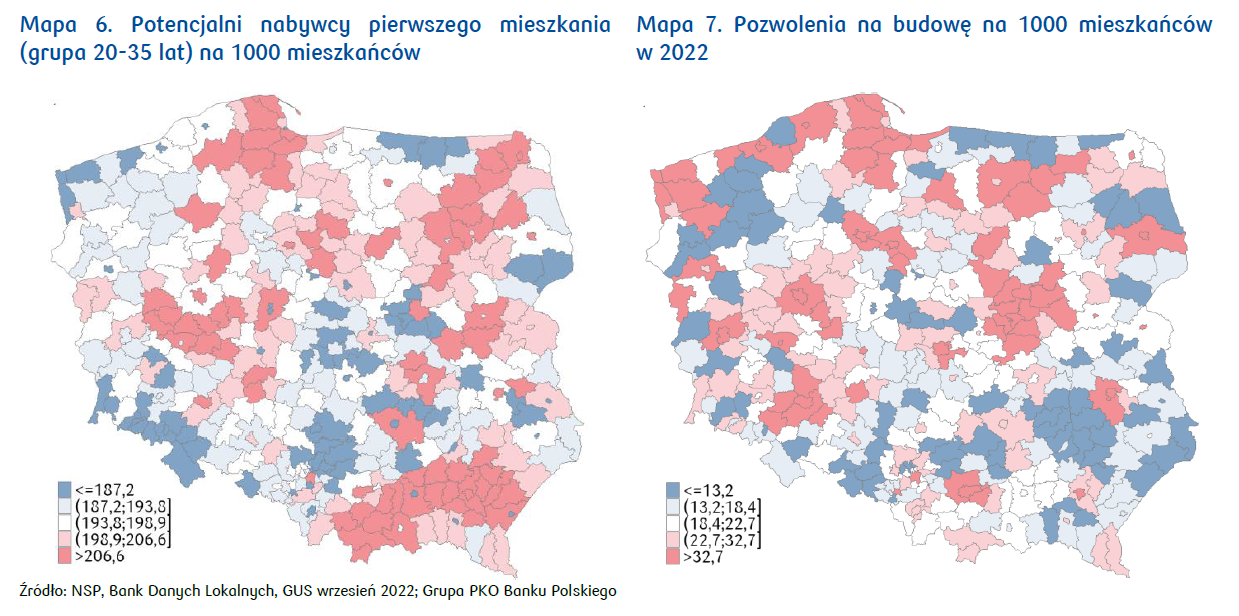

A comparison of regions with a large share of residents aged 20-35 years (potential first home buyers) with housing saturation shows a significant relationship - in districts with a relatively high proportion of young people (and potentially young households), housing saturation is relatively low. This dependence is observed not only in large cities. Low housing density may be a result of the high proportion of single-family housing in these counties, with frequent cohabitation of multiple households and the choice to live in multigenerational households. However, this may also be caused by a housing shortage.

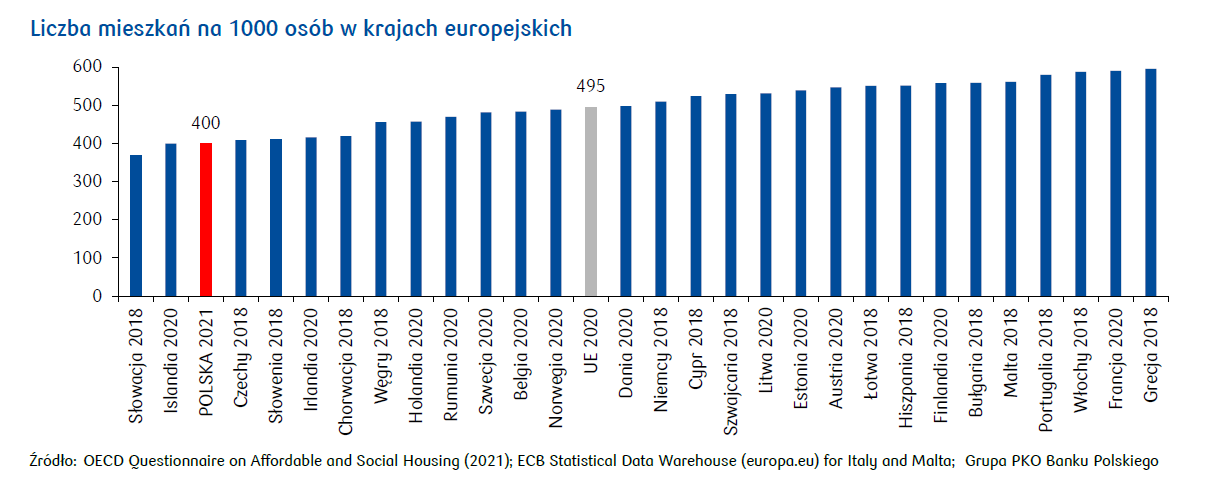

Compared to EU countries, in terms of housing saturation, Poland is, despite an improvement compared to the previous census, in the group of countries with the lowest level of this indicator.

2021 Census Results

The gradual publication of the results of the 2021 population and housing census by the General Directorate of Statistics (GUS) provides more and more information about how the housing situation has changed in individual districts during the intercensal period. This article analyzes how the situation has changed in individual regions in terms of housing saturation, i.e. the number of apartments per 1000 people. In anticipation of further regional housing data, the size of the age group 20-35 years in individual counties was also analyzed - this may be indirect, approximate information about the regional need for first housing.

Fast pace of housing renewal

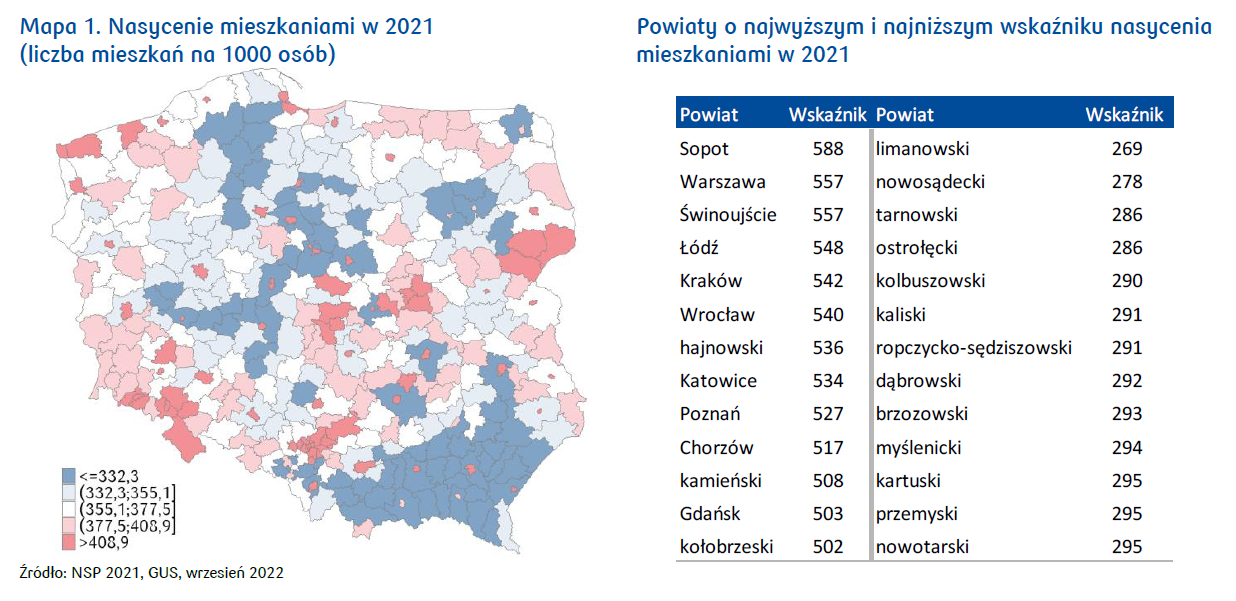

The number of apartments per 1000 people is the simplest synthetic indicator of meeting the housing needs of the population. During the intercensal period, it grew in Poland to an average of 400 apartments per 1,000 people (compared to 353 apartments per 1,000 people in 2011). At the same time, there is a significant regional differentiation of this indicator: the highest level (588 apartments) is observed in Sopocie, the lowest (269 apartments) in Limanowski County (Map 1).

Changes in the indicator are usually determined by two factors - changes in the population in the region and changes in the housing stock associated with the intensity of construction and the depletion of decapitalized resources.

In 2011-2021, the population of Poland decreased by 475 thousand people

In 2011-2021, the population of Poland decreased by 475 thousand people, which slightly improved the average level of the saturation index. Increasing the housing stock was key - 1.7 million apartments were built over 10 years. The share of new construction in Poland's total resources averages 11.3%, so there has been a noticeable renewal of resources. The situation varies greatly by region (Map 2).

A significant (more than 20% of the resource) renewal of the housing stock (and an increase in housing saturation) occurred in powiats bordering the largest agglomerations (including wrocławski, gdański, poznański, wołomiński), in the largest and largest cities (Wrocław, Kraków, Gdańsk, Warszawa , Poznań, Białystok, Olsztyn, Rzeszów, Zielona Góra), as well as in counties attractive to tourists, especially in the coastal zone (including pucki, kartuski, wejherowski, koszaliński, kamieński, kołobrzeski). The high intensity of construction in the districts adjacent to the largest cities was generally accompanied by an increase in population, which somewhat weakened the improvement in the saturation index.

At the other pole in terms of the intensity of housing renovation are the provinces of northeastern Poland-from the voivodeships of warmińsko-mazurskiego (including braniewski, bartoszycki, kętrzyński), podlaskiego (including sokólski, moniecki, siemiatycki, hajnowski), lubelskiego (including krasnostawski, hrubieszowski, tomaszowski), as well as świętokrzyskiego voivodeships (kazimierski, ostrowiecki), śląskiego and opolskiego (border provinces).

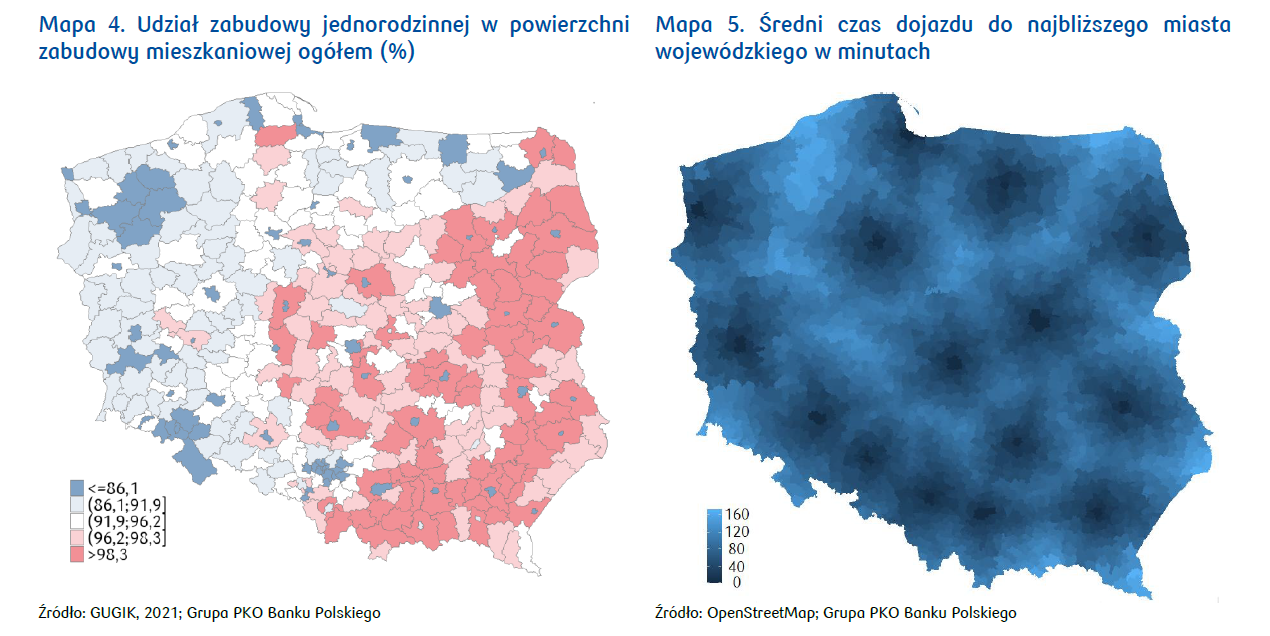

These are areas with relatively weak economic development potential, moderately attractive from a tourist point of view, often with a strong population decline. For these regions, there is often a passive factor, i.e., a decrease in the population improved the level of housing saturation. The improvement in housing saturation due to an increase in the number of apartments is well illustrated by the intensity of construction – the average annual number of commissioned apartments per 1000 population in individual districts (map 3). Over the past decade, the most housing has been built:

* in large agglomerations with a large labor market and good development prospects;

* in the provinces surrounding the largest cities, with good transport links (map 5), with the advantage of lower construction costs, better accessibility of land for construction and a more favorable natural environment (quiet, clean, green);

* in areas attractive to tourists (especially the coastal strip and foothill towns, if there are plots);

* in the powiats with an advantageous transit location (important transport routes passing through the Powiat, border crossings within the borders of the Powiat).

Severely limited construction activity was typical for the provinces with a significant decrease in population and located in regions with weak development potential.

The saturation index is a typical quantitative indicator that does not take into account the quality of housing conditions. Its level can be significantly influenced by the size structure of apartments, as well as the nature of the development (type of building). A high level of saturation may be present in regions with a large number of small apartments and mean uncomfortable living conditions (high population density).

In turn, low housing saturation in a region with a large proportion of single-family developments may mean a shortage of individual apartments (frequent cohabitation of households), but, at the same time, may also mean good conditions in terms of affordable living space (usually typical for single-family houses). The scale of the problem is well illustrated by the proportion of single-family houses in the total living area (map 4). In many regions of eastern and southern Poland, low housing saturation may be the result of a large proportion of single-family homes.

The publication of subsequent regional census results characterizing the size of apartments by area, type of building, as well as the number and structure of household sizes, will allow for a better understanding of the conditions of the level of saturation of the region with housing and clarify the needs of the region for housing.

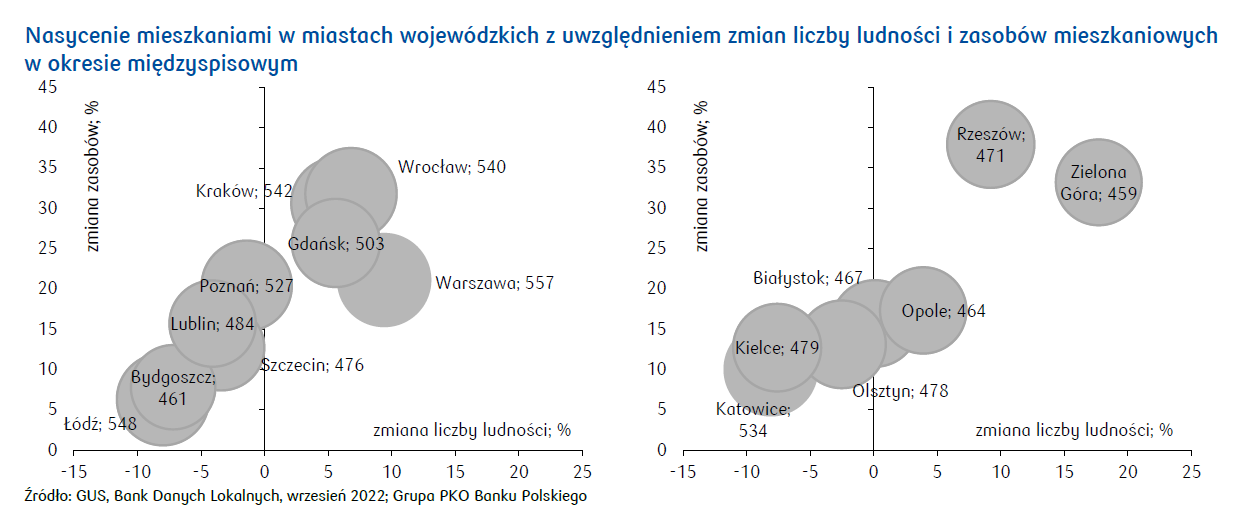

Significant changes in urban population

The largest Polish cities were located in the group of districts with the highest and highest levels of saturation, however, changes in housing stock and population occurred in them with varying intensity. During the inter-census period, the largest growth in both the number of apartments and the number of residents occurred in Wrocławiu (31.8% more apartments and 6.8% more residents) and Krakowie (30.6% and 5.7%, respectively). A large increase in the number of apartments and residents also occurred in Warszawie and Gdansk.

In other large cities with a population of more than 300,000 people, with a decrease in the population from 1.4% to 8%, the number of apartments increased from 6.3% to 20%. In the group of small provincial towns, high population and apartment growth should be noted in Rzeszowie (by 9% and 38%, respectively) and Zielonej Górze (with the inclusion of the rural gmina Zielona Góra into the city of Zielona Góra in 2015). Katowice also stands out with a slight increase in the housing stock (by 10%) and a decrease in the number of residents by 8%.

* Wrocław (+6.8%) has overtaken Łódź (-8%) and is currently the third largest city after Warszawie and Krakowie;

* Białystok (+0.1%) is ahead of Katowice (-8.1%) and is the 10th largest city in Poland;

* Rzeszów (+9%) was ahead of Kielce (-7.6%), Rzeszów is one of the most dynamically developing provincial towns in Poland;

* Zielona Góra (+17.7%) was ahead of Opole (+3.9%); both cities had expanded administrative boundaries.

The dynamic situation of the last two years, especially the huge influx of war refugees from Ukraine, has changed the distribution of the Polish population registered during the census. It is estimated that about 1.3 million refugees will remain in Poland for a long time. As a rule, refugees are sent to the largest Polish cities, most likely counting on the potential of the labor market and effective organization of access to humanitarian aid. Thus, they increase the number of residents of Warsaw, Wroclaw, Trumei, Poznan and Krakow agglomerations, increasing the already heavy burden on housing. The weak labor market in Eastern Poland probably did not attract new residents, despite the relatively high housing saturation in this region.

Where do you need the "first apartments" the most

According to the 2021 census, about 7.7 million people aged 20-35 lived in Poland. It is in this age group that, for natural reasons, the majority of households are located, which create demand for the so-called first home. In terms of 1000 inhabitants, most of these people lived in Subcarpathian, Lesser Poland, Pomeranian voivodeships, southern provinces of Greater Poland Voivodeship and in most provincial towns (map 6).

A comparison of this distribution with regional housing saturation (Map 1) shows a significant overlap – in regions with a relatively high proportion of young people (and potentially young households), relatively low housing saturation. This correlation is observed not only in large cities. Low housing saturation may be the result of a high proportion of single-family housing in these areas (map 4), frequent cohabitation of households and the choice to live in a family consisting of several generations. However, this may be caused by a shortage of housing.

Changes in this situation are unlikely to be brought by the construction of apartments that currently have the status of apartments with a permit (map 7). Their construction in the next 2-3 years will only partially satisfy the housing needs of young families. Building permits are concentrated in the same places - agglomerations with adjacent areas, in the coastal strip and the area of the Warmian-Masurian lakes (probably a large share of investment demand in both these regions).

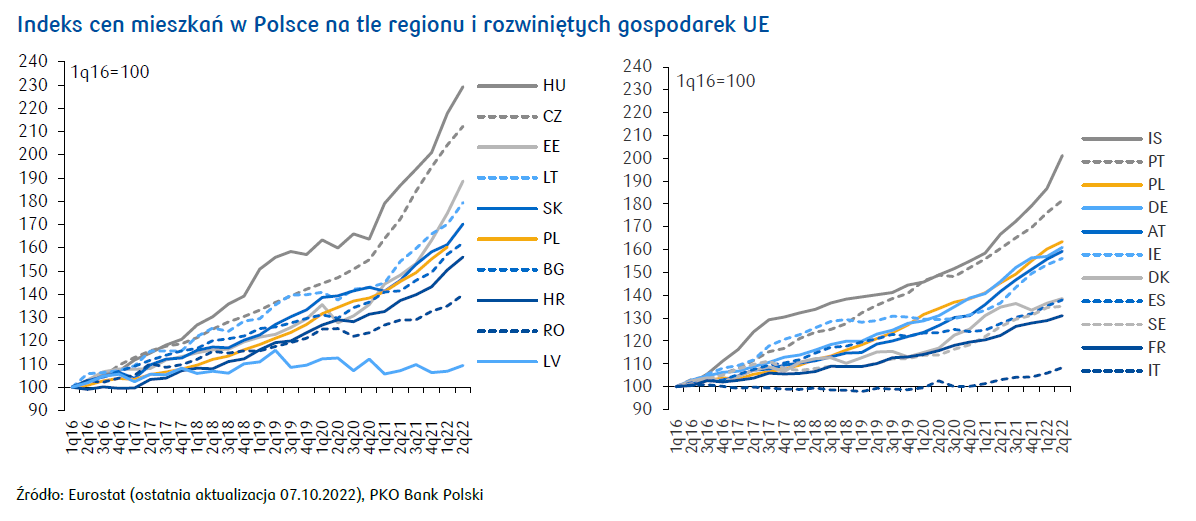

Poland against the background of European countries

Compared to the EU countries, Poland is still in terms of housing provision, despite an improvement since the previous census to 400 apartments per 1,000 people, in the group of countries with the lowest level of this indicator - next to Slovakia (370), Iceland (399), the Czech Republic (408), Slovenia (411), Ireland (416) and Croatia (419) with an EU average of 495 apartments per 1,000 people.

In 2021, the EU average exceeded 13 powiats in Poland (out of 380 powiats).

The real estate market on the charts

Source: portalnieruchomosci.com

Blog

Powiats and gminas bordering with Warsaw

Powiats and gminas bordering with Warsaw

How many years do you have to work to earn money for an apartment in Warsaw

How many years do you have to work to earn money for an apartment in Warsaw